Sant Josep sea‑view detached house — VIVLA’s listing

VIVLA presents a furnished, 3‑bed detached house in Sant Josep de sa Talaia as a fractional share—an entry‑level island exposure priced at EUR 175,000 with pool, terrace and sea views.

Nestled in Sant Josep de sa Talaia, this three‑bedroom detached house presents a clear, data‑centric opportunity for international buyers seeking island exposure with limited capital outlay.

Discovering the Sant Josep detached house with VIVLA

Listed at EUR 175,000 as a fractional ownership share, the property spans 100 sqm of living area on a 100 sqm plot with three bedrooms and two bathrooms. The listing is newly constructed (2025) and sold furnished, with air conditioning, a private terrace and garden, a communal swimming pool and unobstructed sea views—features that matter for both leisure use and short‑let demand. As shown in the photos, the layout prioritises sunlight and indoor–outdoor flow, which supports higher seasonal occupancy rates when marketed correctly.

Property features that drive investor returns

At a headline price of EUR 175,000 for a 100 sqm share, the implied price per square metre is EUR 1,750 — attractive relative to single‑owner island villas, but remember this is a fractional offering. Fractional structures lower entry cost and shift ongoing costs to shared maintenance; they also change revenue mechanics and tax treatment, so buyers should model net yield on their share, not the whole asset.

Features that matter for yield

• Sea view and proximity to beaches — supports premium nightly rates in high season. • New construction and furnished condition — reduces immediate capex but check warranty and common‑area provisions. • Pool and terrace — desirable for short‑let listings and family holiday renters. • Fractional ownership — lowers upfront capital but introduce shared operating costs and booking allocation rules.

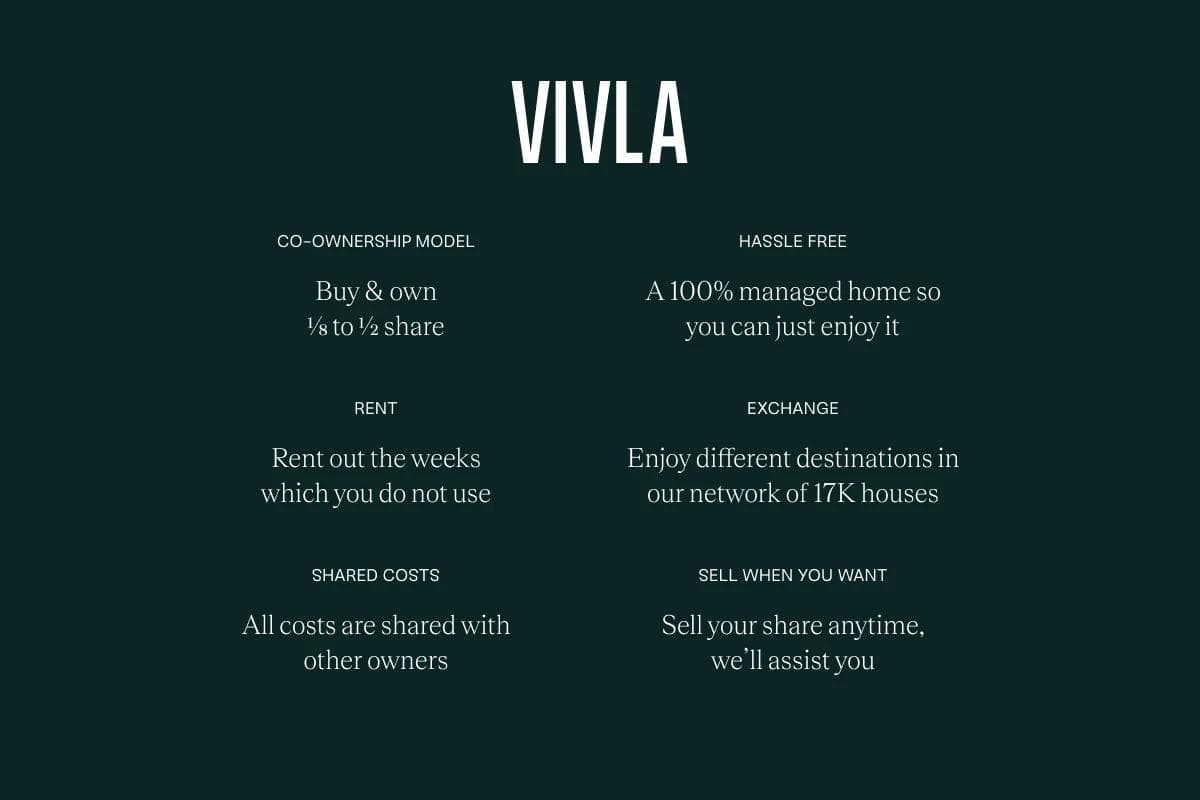

How VIVLA sourced and presents this opportunity

VIVLA’s Madrid‑based team specialises in vacation homes, new construction and rental optimisation — competencies that show in the way this property is packaged. They identified a newly built, furnished asset with turnkey appeal for seasonal demand and positioned it as a fractional share to broaden the buyer pool. The accompanying photography and floor‑plan presentation (see the images) emphasise rental‑relevant attributes — terrace lines, pool access and sea vistas — which helps translate local amenity value into revenue assumptions for international buyers.

VIVLA’s public profile: four years in operation and a rating of 44/100 — this signals a young agency with niche specialisms but also suggests buyers should perform standard diligence: verify management agreements for the fractional scheme, confirm insurance and reserve fund rules, and request historic operating statements for comparable managed assets on the island.

Sant Josep de sa Talaia: local demand drivers and risks

Sant Josep combines high‑quality beaches, established tourist circuits and a local village economy — characteristics that generate steady peak‑season demand but also pronounced seasonality. Short‑let occupancy typically concentrates in summer months; investors should model effective annual occupancy (not peak occupancy) when estimating net yield. Key local variables: proximity to well‑rated beaches, access to seasonal transport and the regulatory environment for short‑term rentals on the Balearic Islands, which has tightened in recent years and can affect licence availability and permissible rental days.

Practical checks for buyers considering similar listings

1) Request the fractional ownership contract and a sample ledger for shared costs. 2) Confirm short‑let licensing and local tax treatment for non‑resident owners. 3) Run conservative occupancy scenarios (30–50% annual) and stress test with off‑peak pricing. 4) Verify who manages bookings, cleaning and maintenance and whether there’s a dedicated reserve for capital repairs.

The property photos included with the listing show the asset’s rental readiness: furnished interiors, clear sightlines from living areas to the terrace, and an exterior presentation that supports premium seasonal positioning. Use these images to validate condition claims rather than replace in‑person inspection.

A final assessment and next steps

For international buyers seeking exposure to Ibiza’s short‑stay market with limited capital, this fractional share offers an efficient entry. VIVLA’s local sourcing and packaging reduce search friction, but prospective purchasers must quantify net yield using conservative occupancy and include fractional governance costs in total cost of ownership. If you want a model built for this specific listing — net yield after management fees, taxes and fractional charges — contact VIVLA through their Madrid office to request management agreements, recent comparables and an owner‑level pro‑forma.

Danish relocation specialist who moved to Cyprus in 2018, helping Nordic clients diversify with rental yields and residency considerations.