Sant Josep sea‑view detached house — VIVLA’s listing

VIVLA presents a furnished 3‑bed detached house in Sant Josep de sa Talaia — fractional ownership at EUR 175,000 per share, sea views, pool access and turnkey operation.

Nestled in Sant Josep de sa Talaia, this three‑bedroom detached house represents a pragmatic island investment: modern construction, private outdoor space, sea views and a fractional‑ownership structure that lowers the entry price to EUR 175,000 per share.

Discovering a compact sea‑view detached house

The property spans 100 sqm of internal living area and sits on a 100 sqm plot. As shown in the photographs, the design favours daylight, large glazed openings and a compact flow between living area, terrace and garden — a layout that supports both holiday use and short‑let operation. The listing price reflected in VIVLA’s portfolio is EUR 175,000 for a fractional share rather than full title transfer, which materially changes investment math compared with outright purchase.

Key physical attributes

- Three bedrooms and two bathrooms configured across an open‑plan 100 sqm interior. - Private terrace, small garden and communal swimming pool that the images clearly document. - Sea views from the terrace and living areas; air conditioning and furnished turnkey presentation. - New construction (completed in 2025), which reduces short‑term capital expenditure risk on structural components.

How this property functions as an investment example

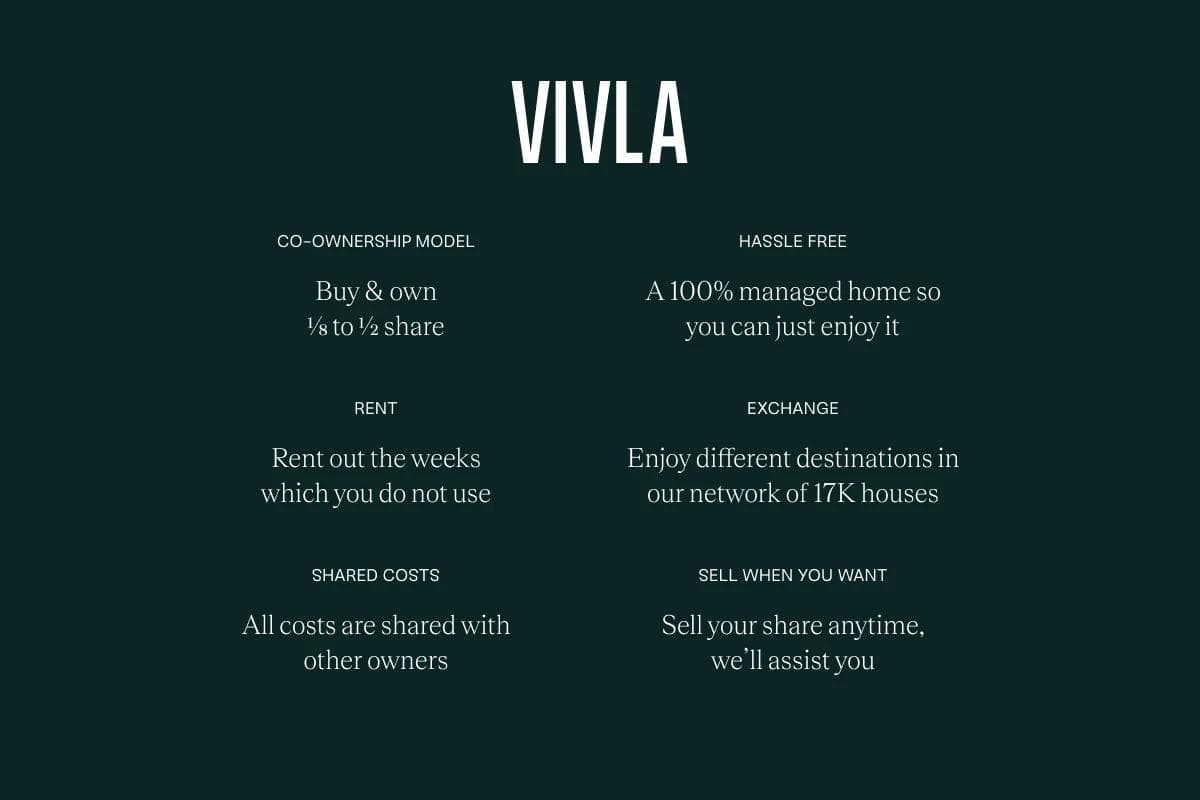

Treat this home as a case study rather than a single data point. Fractional ownership lowers upfront capital commitment but introduces shared governance, variable occupancy schedules and split rental income — all of which must be modelled into net yield (rental income after management fees, taxes, and fractional maintenance contributions). VIVLA positions this type of asset to buyers who prioritise access and diversification over sole title control.

Practical yield considerations

Calculate returns by converting the share price into equivalent full‑property value, then apply local short‑let rate assumptions and cost lines. Important drivers here are: - Seasonality: Ibiza’s summer demand concentrates revenue into a limited calendar window. - Management & platform fees: fractional models typically add an ongoing management layer. - Taxes and occupancy rules: non‑resident tax treatment and short‑term rental regulation in the Balearics affect net returns.

VIVLA’s role: sourcing, curation and local execution

Based in Madrid, VIVLA has focused its four‑year build‑out on connecting international buyers with island and coastal stock — new construction, vacation homes and investment units. For this Sant Josep property, VIVLA’s value proposition is threefold: targeted sourcing of fractional and new‑build opportunities, transparent documentation for international purchasers, and on‑the‑ground coordination for lettings and maintenance. The images accompanying this listing illustrate the standard VIVLA seeks: accurate condition photography, clear amenity depiction and contextual shots that show proximity to coast and village nodes.

Where VIVLA adds measurable value

- Due‑diligence packaging: technical reports, community statutes for fractional schemes, and cash‑flow templates tailored to non‑resident tax regimes. - Market positioning: advising on realistic seasonal occupancy and headline nightly rates based on comparable Sant Josep inventory. - Operational handover: local management partners for bookings, cleaning and pool/garden upkeep to protect net yield.

Sant Josep de sa Talaia: market characteristics that matter

Sant Josep balances village scale with strong tourist demand from mid‑May to September. For investors, the municipality’s attraction lies in constrained development in certain coastal zones, consistent seasonal rental demand, and a premium for properties with sea views. The property images show the local character and the immediate amenity set — small gardens, terraces and pool access — which tends to appeal to family short‑lets and higher‑spend holiday groups.

Risks and regulatory context

- Regulatory: Balearic regulations on short‑term rentals are stricter than some mainland areas; confirm licensing and permitted use. - Seasonality: expect concentrated cash flow; model annualised yield rather than peak month performance. - Fractional governance: review the management agreement for service levels, replacement reserves and exit mechanics.

A practical checklist for buyers considering similar Sant Josep properties

1) Confirm legal structure: full title vs fractional share and associated voting/usage rights. 2) Demand test: review comparable short‑let rates for similar three‑bed homes in Sant Josep for the past three seasons. 3) Total cost of ownership: include community fees, management, utilities, insurance and periodic refurbishments. 4) Exit pathway: how are shares marketed, and what liquidity can be expected? 5) Local tax impact: obtain non‑resident tax estimates and rental VAT/municipal charges.

Why contact VIVLA about this listing

If this Sant Josep offering matches your allocation goals — low capital entry, seasonal rental upside, and a managed ownership model — VIVLA can provide the full dossier: financial modelling that converts the share price into an effective cap‑rate scenario, legal documentation for fractional schemes, and a recommended operations partner for island management. The photos make the asset transparent; VIVLA’s documentation makes the numbers traceable.

For international buyers evaluating Balearic opportunities, the combination of on‑island insight and documentation discipline reduces execution risk. Reach out to VIVLA to request the property pack, ask for a cash‑flow template tailored to non‑resident tax profiles, or arrange a viewing in Sant Josep de sa Talaia.

Danish relocation specialist who moved to Cyprus in 2018, helping Nordic clients diversify with rental yields and residency considerations.